The commentary of the Management Board of Unibep SA to the financial results of the Unibep Group for the first half of 2023

In the first half of 2023, the Unibep Group achieved revenues from its core operations totalling PLN 1,235.6 million, indicating a 21.2% increase compared to the corresponding period last year. The growth in turnover occurred primarily in the construction segment (20.5%), owing to the increased activity in the power and industry segment (381%) and residential construction (24%). The revenue from modular activities was also higher by approx. 24%.

The operating profit of the Group reached PLN 27.7 million, and it decreased by approx. PLN 22 million, i.e., close to 44%, compared to previous year. The decrease in the operating result was primarily a result of lower margins in the modular segment and in residential, office, and industrial construction, offset by noticeably higher profitability in the Power and Industrial Construction segment.

The gross profit of the Unibep Group was approx. 76% lower than the previous year. In addition to the factors mentioned above, the profit was also significantly affected by the results in financial activity (decrease by approximately PLN 16 million compared to the first half of the previous year), mainly due to higher interest costs, negative exchange rate differences, and the valuation of financial assets.

The significant difference between the net profit and the net profit attributable to the shareholders of the parent company arises from the execution of development contracts in a joint venture (JV), the results of which are partially excluded from the profit attributable to the shareholders of Unibep SA. In the first half of 2023, the Group’s report recognised the results of two such contracts.

At the end of the first half of 2023, the Groupss cash balance amounted to PLN 120.6 million compared to PLN 133.8 million at the end of the first half of 2022. According to the cash flow report, the cash balance decreased by PLN 13.2 million compared to the same period in 2022. The reduction in cash during the first six months of the current year was primarily attributed to negative flows from operational activities (minus PLN 35.2 million), mainly due to the increase in liabilities. The Group recorded positive cash flows of PLN 15.2 million in financial activities, primarily due to an increase in the balance of financial liabilities by approx. PLN 56.9 million, mainly resulting from the issuance of bonds by Unidevelopment SA).

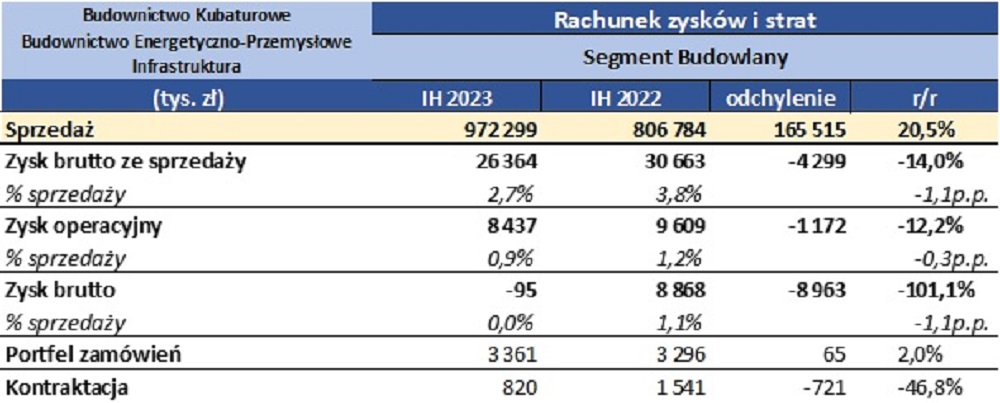

In the construction segment, covering residential, office, and commercial construction, the infrastructure segment, and power and industrial construction, the sales amounted to PLN 972.3 million (an increase of 20.5% year on year). The Power and Industry Construction segment exhibited the highest turnover growth rate, reaching 381%. The dynamic growth in this part of our activity is a result of the base effect. This segment started its operation in the first quarter if 2022, implementing three contracts. Currently, several projects are being implemented within this area.

The operational profitability experienced a slight decrease, from 1.2% in the first half of 2022 to 0.9% in the first half of 2023. Within the construction segment, we observed an improvement in profitability in the industrial and power construction sectors, while simultaneously witnessing a significant decline in the profitability of residential and commercial construction.

Lower operational profitability of our largest segment, residential and commercial construction, results from the increase in prices of materials and subcontracting, observed mainly since the outbreak of the war in Ukraine. While it is true that we have observed some stabilisation in this area in recent months, the prices of basic components and services have remained at a very high level. This increase in prices is not always successfully offset by the additional payments received from investors, who quite often delay the implementation of even agreed-upon revaluations. In the opinion of the Board, the noticeable slowdown, especially in the development segment, is beginning to translate into growing pressure on general contractors to lower their margins. As a result, there are noticeable difficulties in securing contracts at an acceptable level of profitability. It seems that in the near future, it is the rational acquisition activity that will pose the biggest challenge for this segment.

The decrease in the operational profitability of the infrastructure segment can be attributed to sales being nearly half of what they were in the previous year. With nearly identical gross sales profitability as the previous year, the realized value margin was also two times lower. This, considering similar management costs and operational results in other segments, resulted in a lower operating result.

In the first half of 2023, within the construction segment, we secured contracts totalling approximately PLN 820 million. Consequently, the order backlog for this segment reached around PLN 3.4 billion, slightly higher than in the corresponding period the previous year. Faced with significantly lower value of agreements signed in the first half of 2023 compared to the same period last year (PLN 1.5 billion) and considering the current market situation, the Board has revised its earlier forecasts regarding contracting in the entirety of 2023. In our assessment, the construction segment will experience a noticeably lower performance compared to the previous year.

In the nearest future, the activity of this segment will be focused on acquiring and initiating new contracts, based on updated implementation costs and cash flows. Still, a crucial factor influencing the segment’s results will remain the size of additional payments and revaluations received from investors. The biggest risk of this segment is associated with acquisition taking place in conditions of slowdown and intense competition.

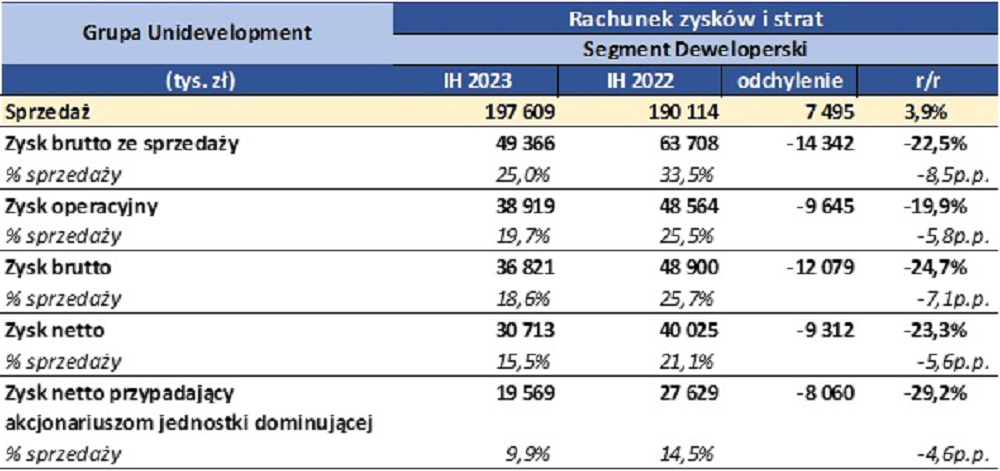

In the results of the first half of 2023 for the development segment, the Group recognised the sales (handover inspection reports) of 432 residential units (including 271 under joint venture), compared to sales of 336 units (including 177 under joint venture) in the first half of 2022. The financial results for the first half of 2023 have been mainly influenced by handovers in the following investments: Fama in Poznań (270, sale to an institutional client), Osiedle Idea in Radom (85), and Latte in Warsaw (76). The development segment sales in the first half of 2023 reached the volume of 198 residential units, compared with 208 residential units in the first half of 2022.

The Unidevelopment Group achieved an operating profit of PLN 38.9 million (compared to PLN 48.6 million in the first half of 2022). The decrease in profitability of this segment is attributed to the sales structure, with a significant portion comprising sales of a package of residential units to institutional clients. Such transactions are characterised by lower margins compared to the sale of apartments to individual buyers. Despite lower profitability of this segment, the Board does not perceive other negative trends in the development market. On the contrary, according to the Management Board’s assessment, the demand for new apartments in the second quarter of 2023 exceeded that of 2022, influenced by the relaxation of conditions in Recommendation S regarding the assessment of creditworthiness for individuals applying for a housing loan and the implementation of the governmental housing programme “Safe credit 2%“. The increased demand for new apartments coincided with a low supply of apartments in both the primary and secondary markets, which allows us to look with optimism at the sales and profitability of this part of our business in the coming quarters.

Our main task within the Development Segment is the efficient launch of new projects according to schedule, as well as offering attractive and market-adapted solutions (for instance Sadyba Spot in Warsaw or Kusocińskiego investment in the Tricity area). In recent years, we have observed the time required to obtain all permits in the development segment getting longer, which may result in delays in commencing the implementation of some of our investments.

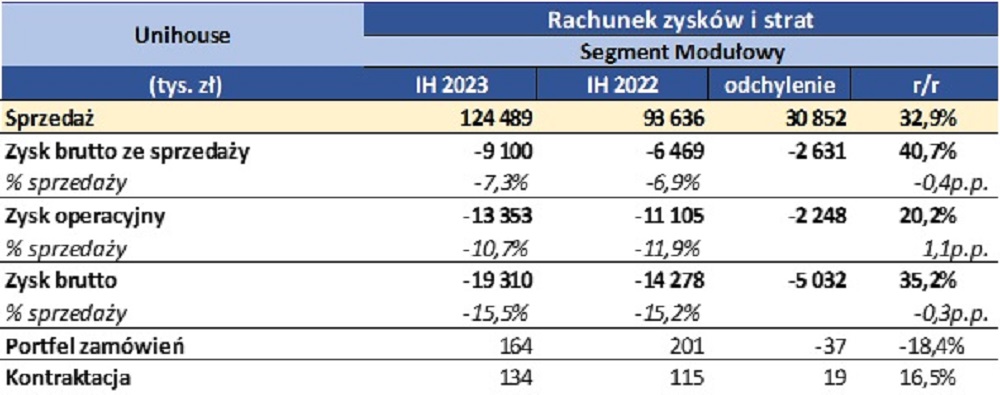

The modular segment, operated by Unihouse SA, achieved sales at the level of PLN 124 million in the first half of 2023, representing a year-to-year increase by approx. PLN 31 million. The profitability at the gross margin level is comparable to the previous year. The operational profitability has slightly improved, still remaining negative. The correction of margins on contracts due to higher production costs (increases in material and subcontractor service prices, as well as higher freight and transportation costs) had the greatest impact. Provisions for these costs were made in 2022. While a significant portion of these contracts was executed in the first half of 2023, the provisions from 2022 meant they did not contribute to the 2023 results. Furthermore, their execution tied up production capacity, preventing coverage of current fixed and financial costs. An additional factor contributing to the negative results of the first half of 2023 had the verification of assumptions on the final level of contract revaluations after the final settlements with investors (on completed investments).

In the third quarter of 2023, the contracts from 2022 will mostly be completed, and new investments will be launched with new assumptions based on current prices of materials and services. With the completion of contracts from 2022 and the commencement of newly acquired contracts with higher margins and indexing clauses therein, we anticipate a gradual improvement in margin at the turn of the third and fourth quarters this year. However, the result for this segment’s operations is expected to remain negative throughout 2023.

In the first half of 2023, there was an increase in production volume, which we view positively in terms of the continuous efficiency increase of our factory. The production amounted to 15 457 m2 In the analysed period, while 12 768 m2 were produced in the corresponding period of 2022. Maintaining such a trend allows for an optimistic outlook on the successive growth of margins in the upcoming quarters of 2023 and in the following years.

In the period under review, the level of contracting amounted to PLN 134 million. The current order backlog of this segment is 164 million PLN. What is more, approx. PLN 87 million constitute conditional contracts, the commencement of which depends on the decisions of the ordering parties, meeting administrative conditions, obtaining financing, or achieving a particular level of apartment sales. The current level of orders is insufficient to fully utilise production capacity; however, considering the number and value of projects in the negotiation phase, we expect that the total value of contracts signed in 2023 will be significantly higher than in 2022.

The main task within the Modular Segment is to acquire additional orders calculated based on the current cost forecast and negotiated indexation clauses. It would allow for efficient preparation and ensure continuity of production in the near future.

The outlook

In the first half of 2023, the Unibep Group acquired contracts with a total value of approximately PLN 950 million. As a result, the backlog for implementation from the third quarter of 2023 amounts to approx. PLN 3.5 billion, which means it is at a similar level compared to the corresponding period last year.

In the Board's assessment, the greatest prospects for contracting lie within the infrastructure and power and industry sectors. The infrastructure segment, in the coming quarters, will focus on leveraging the potential associated with the geographic diversification and increasing the share of large contracts in the order portfolio. For the power and industry segment, we anticipate significant opportunities in offering services in the hydrotechnical market, the development of energy transmission and distribution infrastructure, and finally, in the renewable energy sector." We will dedicate additional efforts to acquiring a technological partner for the implemented projects. The main actions will therefore aim to restructure the organisational structures, increase human and equipment resources, so as to significantly increase the share of both areas in the revenues and the margin of the construction segment by 2026.

In the field of residential construction, efforts will be directed towards increasing the participation in public projects and preparing the segment to actively participate in the reconstruction of Ukraine. In the near future, the Management Board will continue negotiations aiming to adjust some of the contracts being implemented and accept the revaluation clauses in new agreements. Increasing the indexation indicators by the ordering parties in residential and infrastructure construction would help mitigate the effects of previous increases in material and service prices. We will undertake efforts to adjust our compensation both in the public and private sectors.

As mentioned earlier, we notice that the Development Segment offers a significant impetus for further market development. The launch of the government housing program “Safe Credit 2%” has significantly contributed to a noticeable increase in demand for new apartments, with the number of customers, especially in the second quarter of 2023, higher than in 2022. Considering the very limited supply of new apartments, it creates natural conditions for the development of this business segment. Currently, we have the potential to build approx. 5,000 residential units under multi-stage investments. In the nearest future, the efforts within the Group will focus on launching new projects within the timelines established in their budgets.

In the modular segment, the greatest emphasis has been placed on redefining the markets of the conducted operations. We presume that the revenues from the established but specific Norwegian market with will be gradually replaced with the increased sales in the promising German market (through collaboration with the acquired, regular customers) and the Polish market (primarily based on implementing projects within the social housing initiatives, as well as constructing nurseries, kindergartens, hotels, and facilities for the military and police). At the same time, the Group has a product prepared for the Ukrainian market, which it could introduce after the cessation of war hostilities.

In the Board’s view, the market situation indicates that the entire year 2023 will be a challenging and demanding period for the construction industry. The dynamic increase in material prices and subcontractor service costs, coupled with high inflation, is causing investors to hold back with new projects. In the perspective of several quarters, this may result in increased pressure to reduce margins.

The current actions of the Management Board will focus, on the one hand, on formulating a new, more conservative approach than the previous policy regarding the recognition of various risks, revaluation agreements, subcontractor charges, service reserves, or creating provisions for receivables, which will result in a decrease in the 2023 annual result. On the other hand, efforts will be directed towards achieving the aforementioned goals in individual segments, aiming to significantly increase sales and profitability of operations by 2026 while also maximising the reduction of the Group’s financial debt.