Management Board’s Commentary on the preliminary estimated financial data of the Unibep Group for Q1 2024

The Management Board of Unibep SA (Issuer) informs that due to the completion on 24 May 2024 of the process of aggregation of preliminary financial data carried out for the purpose of preparing financial statements for the first quarter of 2024, the Issuer has decided to publicly disclose the preliminary estimated selected financial and operational data of the Unibep Capital Group (Capital Group) for the first quarter of 2024, which were published on this day in the ESPI stock exchange system.

Below, the Management Board of the Issuer provides a commentary on the presented preliminary estimated data.

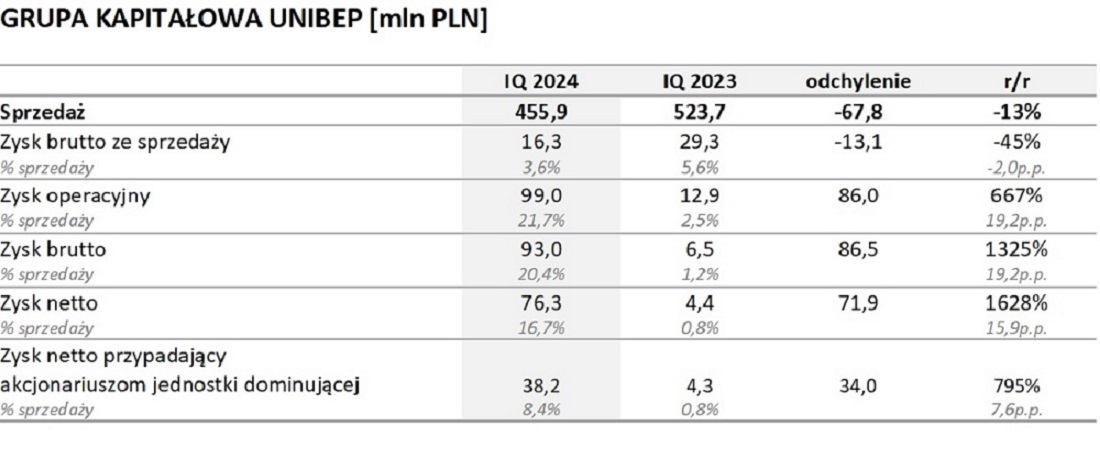

The operations of the Capital Group in the analysed period of Q1 2024 resulted in revenue from core activities amounting to PLN 455.9 million, representing a decrease of 13.0% compared to the same period last year. The decrease in revenue was most significant in:

The operations of the Capital Group in the analysed period of Q1 2024 resulted in revenue from core activities amounting to PLN 455.9 million, representing a decrease of 13.0% compared to the same period last year. The decrease in revenue was most significant in:

- Development segment (by 53.9%);

- Modular construction (i.e., the activities of the subsidiary, Unihouse SA, and separate export transactions of the Issuer) (decrease by 24.8%), and;

- Construction segment (decrease by 3.7%), which includes the following areas: Power and industrial construction, structural construction, and Infrastructure construction. The decline is primarily due to lower revenue in the power and industry segment (decrease by 27.3%), while revenue in the infrastructure segment increased (by 34.5%), and revenue in the structural construction remained at a similar level to last year.

In the analysed period of Q1 2024, the Capital Group achieved an operating profit of PLN 99.0 million. Compared to the previous year, when an operating profit of PLN 12.9 million was recorded, this represents a positive variance of over PLN 86 million.

An important factor influencing the aforementioned preliminary estimated financial results is, however, the effect of one-time events related to the reclassification and valuation of land owned by the subsidiaries of Unidevelopment SA, as reported by the Issuer in Current Report No. 18/2024. The Management Board of Unidevelopment SA has decided to cease preparations for selected land plots intended for residential projects and to maintain these lands to benefit from their increased value. That decision involved reclassifying these land properties from inventory to investment properties and valuing them at fair value. Such valuation had the following positive effect on the presented preliminary quarterly results:

— Operating profit: PLN 100.3 million

— Net profit: PLN 81.2 million

— Net profit attributable to shareholders of the parent company: PLN 45.6 million

The Management Board of the Issuer would like to point out that the Group’s operating profit, adjusted for the impact of the aforementioned effect, is practically neutral, with the adjusted operating loss amounting to only PLN −1.3 million. Considering the losses recorded in the fourth quarter of 2023 in two areas of the Group’s operations, namely the construction segment and the modular segment, this represents a significant step in improving the Group’s operating profitability as well as its cash position. The dynamics of this phenomenon are better than the assumptions outlined in the 2023 report, which was published on 18 April 2024.

In addition to the one-time effect of the aforementioned phenomenon on the analysed level of the operating profit, the results achieved in the individual business segments discussed later in the commentary also had some impact. Furthermore, higher general costs, reflected in the management costs, indicate an increase from PLN 13.7 million recorded in Q1 2023 to PLN 20.8 million in Q1 2024 (an increase of PLN 7.1 million). This change was caused on one hand by the increasing level of employment and wages (following salary adjustments made both during 2023 and at the beginning of 2024), and on the other hand by the new classification of general costs. As a result of reviewing all cost items, the Management Board of the Issuer has reorganised the structure and adjusted it to the current tasks and responsibilities of the broadly defined supporting departments. Currently, the construction supporting teams, which have characteristics of shared services departments, are classified under general management costs. In 2023, they were partially included in the structures of individual business segments as general costs of those segments. The new classification allows for achieving a synergy effect that will positively impact operational results in subsequent reporting periods.

In addition to the operational factors mentioned above, the Capital Group’s results were also impacted by the financial activities outcome (a decrease of approx. PLN 3.0 million year-over-year), primarily due to higher interest costs and additionally due to the valuation of financial assets, such as impairment allowances on receivables calculated in accordance with IFRS 9.

As a result of the aforementioned factors, the estimated net profit of the Capital Group was approximately PLN 71.9 million higher than the previous year. The difference between the net profit of the Capital Group and the net profit attributable to the shareholders of the parent company arises from contracts executed in the joint venture (JV) format, where the results are partially excluded from the profit attributable to the shareholders of the Issuer.

Based on the current state of knowledge and as of the publication date of this report, the Issuer’s Management Board does not foresee any risk to the continuation of the Issuer's activities. At the end of the first quarter of 2024, the Capital Group's cash position was PLN 167.5 million, compared to PLN 108.5 million for the same period in the previous year. This position naturally offsets the financial debt amounting to PLN 360.5 million as of 31 March 2024 (compared to PLN 278.4 million as of 31 March 2023), resulting in a net financial debt of PLN 193.0 million for the first quarter of 2024, compared to PLN 169.9 million for the same period last year.

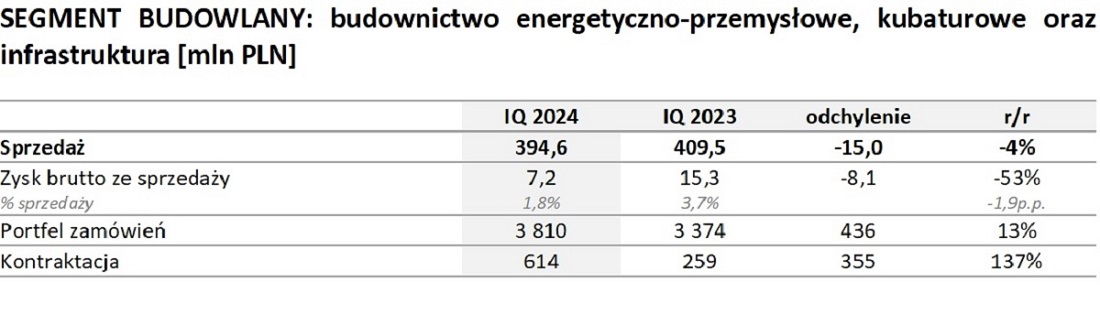

Throughout the first quarter of 2024, the construction segment, which includes the industrial and power construction, structural construction, and infrastructure segments, reported sales of PLN 394.6 million, representing a decrease by 3.7%.

The decrease was most significantly impacted by negative deviations in the industrial and power construction (decrease of 27.3%), which includes reduced production capacities and the cessation of the Umicore contract, a result of mutual termination of the construction agreement by Unibep SA and the ordering party, as reported in the Issuer’s Management Board in current reports No. 10/2024 and No. 11/2024. This sector, which formally began operations relatively recently (in the first quarter of 2022), had been actively expanding throughout 2023 through increased contracting and acquisitions that began in 2022 and continued into the previous year. The Issuer’s current activities in this segment are balanced, and the contracts and orders are signed selectively. This is part of the mid-term strategy outlined in previous public statements by the Management Board, which aims to achieve a lasting improvement in the operational profitability of the entire construction segment of the Issuer. Therefore, when analysing the data for the first quarter of 2024, as well as data in subsequent quarters compared to the same periods in the previous year, an important factor explaining changes will be the effect of the so-called high base.

Sales revenues recorded in the first quarter of 2024 for structural construction show nearly the same levels as the previous year. This area encompasses both domestic activities and operations in Eastern markets. In 2023, the Capital Group began the construction of the Polish Embassy in Minsk, and in subsequent periods, the implementation of the “Szeginie” border crossing on the Ukrainian-Polish border will commence, as reported by the Issuer’s Management Board in current report No. 25/2024. As for the structural construction segment on the domestic market, the Management Board wishes to note that, similarly to the industrial and power construction segment, the contracting and acquisitions here also employ a selective strategy. This approach aims to secure contracts with safe levels of estimated operational profitability.

Within the entire construction segment, there was a very strong increase in turnover (by 34.5% year-over-year) in the infrastructure segment. This is due to the fact that many contracts in this sector are executed in the “design and build” formula, which extends the start of construction work. Currently, many of the contracts signed in 2023 are still in the design phase, but some have entered the implementation phase, which enabled the aforementioned increases compared to the data for the previous year.

From the perspective of sales gross profit, in addition to the aforementioned decrease in total revenues for the entire construction segment, the results recorded in the first quarter of 2024 were negatively affected by the characteristic (prudence-based) valuation of construction contracts, which included losses estimated in the previous reporting period ending on 31 December 2023. These losses had a one-time impact on the results for the fourth quarter of 2023 due to the creation of appropriate reserves, with a neutral effect on subsequent quarters, including the first quarter of 2024. However, in the context of the analysed results, this means that these contracts have no positive contribution to the entire segment, especially for covering general costs of some ongoing construction projects that are still in the process of final acceptance. And it was a marginal phenomenon in the corresponding period last year.

As a result, gross profit margins declined, falling from a gross profit margin of +3.7% to 1.8%, including:

-

The industrial and power construction segment: a decrease in gross profit margin from a gain of 5.5% to a loss of 5.1%;

-

The structural construction segment (domestic and export): a decrease in the gross profit margin from 4.1% to 3.4%

-

The infrastructure segment: an increase in the gross profit margin from a loss of -2.9% to a profit of 4.3%.

Notably, in the first quarter of 2024, within the construction segment, the Capital Group secured contracts with a total value of approx. PLN 0.6 billion (significantly more than in the corresponding period last year). Thus, the backlog of orders for this segment for the upcoming periods reached a value of approximately PLN 3.8 billion, representing an approximate increase by 13% compared to the similar period last year.

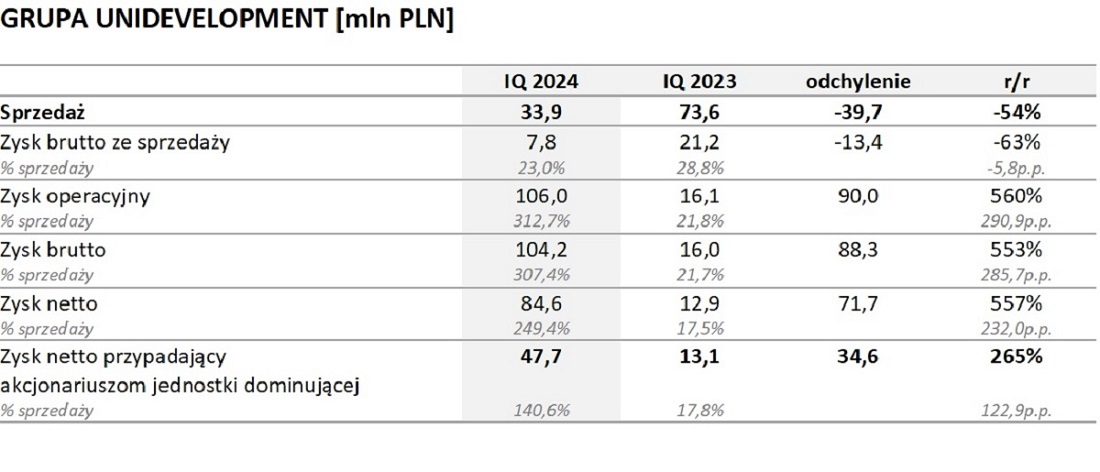

The sales of the development segment in the first quarter of 2024 amounted to PLN 33.9 million, compared to PLN 73.6 million in the corresponding period last year. The approx. 54% decrease in the segment's revenue was in line with the assumptions based on the schedules of the ongoing development projects.

Despite a slight decrease in the profitability of this segment, mainly due to changes in the sales structure, the Management Board of Unidevelopment Group does not expect any negative trends in the development market. On the contrary, according to the Management Board, demand for new apartments in 2024 is expected to remain strong, particularly in urban areas such as Warsaw, Poznań, and the Tri-City. This optimism is bolstered by the fact that the Polish government is finalising a new program to support further development of the housing market in Poland, “Mieszkanie na Start,” which is set to come into effect in the second half of 2024. In the Management Board's view, the visible market demand allows for optimism about the sales of apartments within ongoing and planned development projects, as well as the profitability of this part of the Group's business in the coming periods.

In the results for this segment in the first quarter of 2024, the Group recognised the sale (handover inspection reports) of 42 residential units, compared to the sale of 144 residential units in the same period of 2023. The aforementioned financial result is primarily influenced by the handover of investments in the following locations: Idea Venus estate and Idea Ogrody estate in Radom, as well as Pauza Ochota in Warsaw. In the first quarter of 2024, no sales (handover inspection reports) were recognised for the ongoing project being implemented under a joint venture (FAMA 3), which, according to the schedules, will be implemented in the second to fourth quarters of the current year.

In the current period, the developer sales reached a volume of 89 residential units (including 26 within joint ventures), compared to 107 units (including 55 within joint ventures) in the similar period of 2023.

As a result of the financial data aggregation process, preliminary estimates for the first quarter of 2024 indicate that the Unidevelopment achieved an operating profit of PLN 106.0 million during the analysed period, compared to PLN 16.1 million recorded in the similar period last year.

The greatest impact on the level of operating profit in the first quarter of 2024 had the decision of Unidevelopment to cease development activities on selected land properties and to hold these properties to increase their value. The result of this decision was the reclassification of the aforementioned properties as investment properties, leading to their valuation at fair value. This operation had an impact on the individual items of the income statement as follows:

- Operating profit: PLN 100.3 million

- Net profit: PLN 81.2 million

- Net profit attributable to shareholders of the parent company: PLN 45.6 million

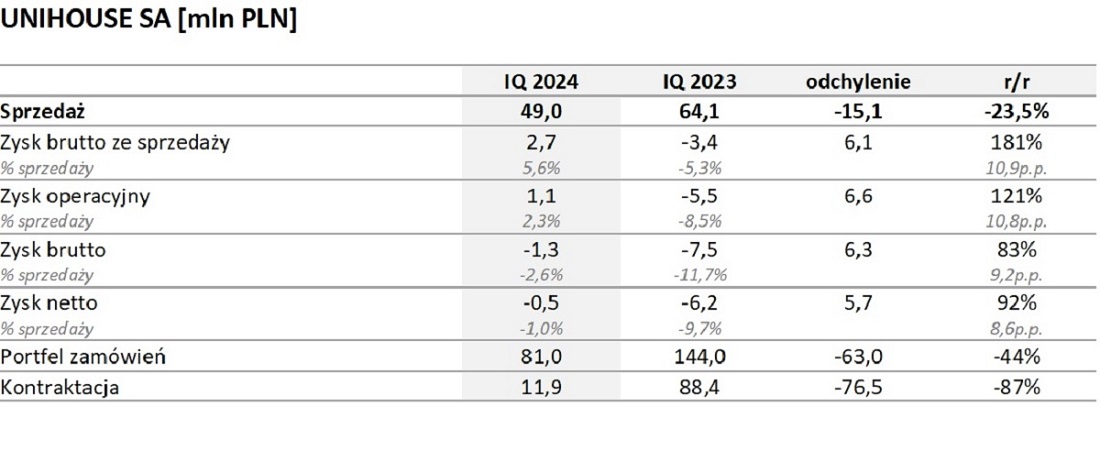

In the first quarter of 2024, the modular segment managed and overseen by Unihouse SA achieved sales of approx. PLN 49 million, which is about PLN 15 million less than in the corresponding period last year. Operating profitability reached PLN 1.1 million and was significantly better (by PLN 6.6 million) compared to last year.

At the turn of the third and fourth quarters of 2023, Unihouse SA implemented a series of reorganisation measures to adjust the production capacity of the Bielsk Podlaski plant to current economic and market conditions. This is now reflected on the one hand, in lower sales, but more importantly, in significantly improved profitability at the EBIT level. The production volume of Unihouse SA in the first quarter of 2024 amounted to 4,023 m2 (decrease of 58% year-on-year).

Since the beginning of 2024, the Management Board of Unihouse SA has been intensively expanding its penetration of the Polish market. Works are also being continued in the Scandinavian and German markets. The Management Board wishes to point out that despite the significant year-on-year decline in production, Unihouse works on contracts signed in previous periods, while maintaining a positive operating margin. Additionally, during the period in question, the level of contracting amounted to approx. PLN 12 million, which translates into a backlog of orders for execution in future periods worth approx. PLN 81 million.

In the first quarter of 2024, the level of contracting was over 87% lower than last year. On the other hand, several important contracts are currently being prepared and developed in the German market. They are expected to be concluded in the second quarter of 2024. The Management Board of Unihouse SA continues to view positively the prospects related to focusing acquisition efforts on the Polish and German markets, where the brand of Unihouse SA is already known. In the area of projects to be acquired, there are contracts with a total value of approx. PLN 500 million.

THE OUTLOOK

The Management Board of the Issuer, as well as the management boards of the subsidiaries forming the Unibep Capital Group, will continue to pursue a policy of choosing contracts selectively in the construction and modular segments, ensuring optimal economic outcomes. Such a policy will slightly limit the development dynamics of construction and modular activities on one hand, but on the other, it will positively contribute to improving operational profitability in future reporting periods. In the case of the development segment, the Management Board will continue to implement sales plans in accordance with schedules for individual investments and a carefully considered pricing policy for individual customers.

As previously mentioned, in the entire first quarter of 2024, the Unibep Group acquired contracts in the construction segment with a total value of approx. PLN 0.6 billion. Consequently, as of 31 March 2024, the backlog of orders for upcoming periods amounted to approx. PLN 3.8 billion, compared to PLN 3.6 billion as of 31 December 2023. At the same time, the value of contracts pending signature, where the Issuer’s offer ranked first in the bidding process, exceeds PLN 0.8 billion. And new orders totalling PLN 0.37 billion were acquired and signed in April and May from this group of pending contracts.

In the opinion of the Management Board, the greatest prospects for contracting lie in the infrastructure and power and industrial construction segments.

As of 31 March 2024, the value of contracts signed in the infrastructure segment in 2024 amounted to PLN 0.4 billion, while contracts currently pending signature amount to an additional PLN 0.36 billion. Among these, the contract for the “Design and Construction of the S19 Expressway on the section from the Białystok North junction (excluding the junction) to the Dobrzyniewo junction (including the junction),” reported by the Management Board in Current Report No. 24/2024, was signed on 14 May 2024. After signing the remaining contracts, the order backlog in this area will amount to approximately PLN 2.12 billion, which, in the Management Board’s assessment, will ensure its stable operation over the next three years. In the coming quarters, the infrastructure segment will focus on leveraging the potential related to geographic diversification and further increase of the share of large contracts in the backlog of orders.

In the power and industrial construction segment, the Capital Group is currently engaged in advanced discussions on several large projects, including those involving potential technological partners. The Management Board of the Issuer continues to see significant opportunities in placing offers in the energy sector, including power transmission and distribution, cogeneration, and renewable energy. As of 31 March 2024, the value of contracts signed in 2024 amounted to PLN 0.1 billion, while contracts currently pending signature total an additional PLN 0.23 billion. After their signing, the backlog of orders in this area will amount to approx. PLN 0.82 billion.

In the area of structural construction (domestic and export), contracting activities will focus on a selective approach to new orders and on seeking projects with the highest bid profitability. As of 31 March 2024, the value of contracts signed in 2024 amounted to PLN 0.1 billion, while contracts currently pending signature total PLN 0.24 billion. After their signing, the backlog of order in this area will amount to approx. PLN 1.68 billion.

In the near future, the Management Board of the Capital Group will continue difficult negotiations on several active contracts in the construction segment to agree with the clients on adjustments and relevant amendments. Currently, however, the impact of these actions is difficult to assess due to the rigidity of the existing contract provisions.

The Management Board of the Capital Group anticipates continued stable growth, and the achievement of goals set for the development segment. As part of the actions taken in this regard, the planned sale of a portion of the land bank through direct transactions may occur as early as the second quarter of 2024, depending on positive feedback from partners in the due diligence for these land properties.

The information mentioned in the commentary on the 2023 results regarding the review of options and scenarios for the Capital Group currently focuses the Management Board’s attention on the potential acquisition of strategic partners for implementation of new development projects for the Unidevelopment Group. In the second quarter of 2024, it is planned to formalise and conduct due diligence processes and finalize discussions with potential partners regarding the terms of such cooperation. These activities represent a significant step in achieving the objectives outlined in previous comments and reports regarding the debt reduction process for the entire Unibep Capital Group. In the Management Board’s opinion, they will bring measurable benefits, and their further impact will be visible in the results in the upcoming reporting periods.

The Management Board wishes to highlight that the growth scenarios for the development segment include new collaboration options with external partners. This pertains to both joint project ventures and the potential involvement of an external minority partner to give momentum the activities of the Unidevelopment Group. This would allow for the initiation of new expansion directions into other complementary residential segments or facilitate the acceleration of territorial expansion in the Polish market.

Efforts are ongoing for the subsidiary Unihouse SA to develop an optimal scenario for further growth in this segment, which also includes options related to the potential involvement of an external business partner or changes in the ownership structure, as initiated at the end of 2023. Currently, this process is at the stage of due diligence being conducted by prospective bidders; however, no decisions in this regard have been made yet. At the same time, based on the implemented market segmentation program, the contracting strategy is being executed, which focuses on the German and Polish markets. Based on this, the Management Board of the Issuer expects that the indicated bidding activities will secure module production to the extent necessary to achieve operational breakeven in 2024, in line with previous assumptions.

In the first quarter of 2024, the Management Board of Unibep SA also conducted a thorough review of internal processes, ranging from the acquisition process, through collaboration with support teams, to oversight of construction sites. The main optimisation efforts within the organisation aim to restructure the financial control system and strengthen operational control processes as well as risk management processes. Their main goal is to achieve a synergistic effect. The Operational Controlling team has now been fully established. This team, in collaboration with contract management, conducts regular reviews of construction contract estimates, analysing in detail all risks and opportunities that could potentially impact future operational results. The Management Board of the Issuer wishes to point out that the presented financial data of the Capital Group represents a true and accurate reflection of the knowledge held in this respect as of today.

The Management Board of the Issuer is confident that the aforementioned optimisation measures will bring measurable benefits in 2024, both financial and performance-related, and will contribute to improving the overall operational profitability of the entire Capital Group. As a result, the operating profit (EBIT) of the Issuer (i.e., Unibep SA) expressed as a percentage of sales, is expected to remain within the range of 1% to 1.5% for the entire year of 2024, in line with previous declarations. This is the expected profitability excluding any extraordinary items related to asset revaluations.