Management Board’s Commentary on the preliminary estimated financial data of the Unibep Group for Q1–Q3 2024

The Management Board of Unibep SA (Issuer) informs that, following the completion on 29 October 2024 of the aggregation of preliminary financial data for the purpose of the preparation of financial statements for Q1–Q3 2024, the Issuer has decided to publicly disclose the preliminary estimated selected financial and operational data of the Unibep Capital Group (Capital Group) for Q1–Q3 2024, published the same day in the ESPI stock exchange system.

Below, the Management Board of the Issuer provides a commentary on the presented preliminary estimated data.

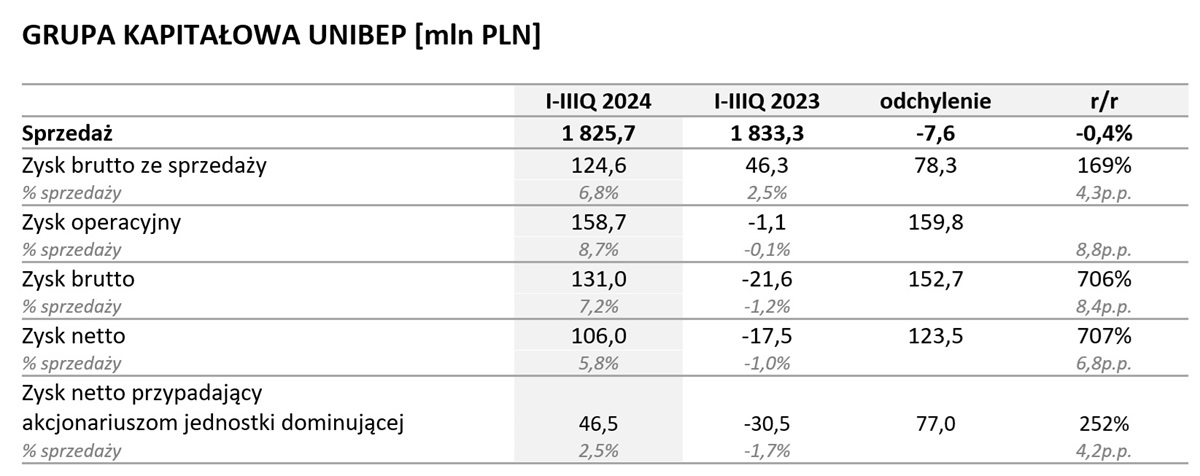

The operations of the Capital Group in the analysed period of Q1–Q3 2024 resulted in revenue from core activities amounting to PLN 1,825.7 million, representing a decrease of 0.4% compared to the same period last year. The decrease in revenue was most significant in:

- Modular construction segment (i.e., the activities of the subsidiary Unihouse SA along with individual export transactions of the Issuer) (a year-on-year decrease of 26%);

- Construction segment (decrease of 3.3%), collectively comprising the power and industrial construction, structural construction, and infrastructure segments. Changes in revenue levels achieved in Q1–Q3 2024 compared to the corresponding data of the similar period last year broke down by business segments:

– Power and industrial construction segment (decrease by 35% year-on-year)

– Structural construction segment (decrease by 8.3% year-on-year),

– Infrastructure segment (increase by 67.9% year-on-year)

At the same time, the developer segment reported a turnover increase of 16.3% year-on-year.

In the analysed period of the three quarters of 2024, the Capital Group achieved an operating profit of PLN 158.7 million. Compared to the previous year, which recorded an operating loss of PLN 1.1 million, this represents a positive variance of approx. PLN 160 million.

An important factor influencing the aforementioned preliminary estimated financial results is, however, the effect of one-time events related to the reclassification and valuation of land owned by the subsidiaries of Unidevelopment SA, as reported by the Issuer in Current Report No. 18/2024. The Management Board of Unidevelopment SA has decided to cease preparations for selected land plots intended for residential projects and to maintain these lands to benefit from their increased market value. That decision involved reclassifying these land properties from inventory to investment properties and valuing them at fair value. The positive impact of the completed operations on the presented preliminary results for Q1–Q3 2024 is as follows:

– Operating profit: PLN 103.2 million

– Net profit: PLN 83.6 million

– Net profit attributable to shareholders of the parent company: PLN 48.1 million

The Management Board of the Issuer would like to point out that the Group’s operating profit, adjusted for the impact of the aforementioned effect, amounts to approx. PLN 55,5 million. Considering the losses recorded in the fourth quarter of 2023 in two areas of the Group’s operations, namely the construction segment and the modular segment, this represents a significant step in improving the Group’s operating profitability as well as its cash position. The dynamics of this phenomenon are better than the assumptions outlined in the 2023 report, which was published on 18 April 2024.

In addition to the one-time effect of the aforementioned phenomenon, the results achieved in the individual business segments discussed later in the commentary also had some impact on the analysed level of the operating profit.

In the analysed period of the three quarters of 2024, the Capital Group recorded an increase in “management costs” showing a change of PLN 21.5 million compared to the same period last year. This change was caused on one hand by the increasing level of employment and wages (following salary adjustments made both during 2023 and 2024), but also due to the separation and reclassification of production support costs, which, since the beginning of 2024, have been recorded and monitored as general expenses of the business activities conducted by the Capital Group. As a result of reviewing all cost items, the Management Board of the Issuer has reorganised the structure and adjusted it to the current tasks and responsibilities of the broadly defined supporting departments, which has been in effect since the beginning of the current year. Currently, the construction support teams, which have characteristics of shared services departments, are classified under general management costs. In 2023, they were partially allocated to the structures of individual business segments as general costs of those segments. The new classification allows for achieving a synergy effect, which has been the case since the beginning of the year, and this will positively impact operational results in subsequent reporting periods, compared to the operating results achieved in the same periods of the previous year.

In addition to the operational factors mentioned above, the Capital Group’s results were also impacted by the financial activities outcome (a decrease of approx. PLN 7 million year-on-year), primarily due to higher interest costs and changes in write-off allowances on receivables and valuation of financial instruments.

As a result of the aforementioned factors, the estimated net profit of the Capital Group was approximately PLN 123.5 million higher than the previous year. The difference between the net profit of the Capital Group and the net profit attributable to the shareholders of the parent company arises from contracts executed in the joint venture (JV), format, where the results are partially excluded from the profit attributable to the shareholders of the Issuer.

Based on the current state of knowledge and as of the publication date of this report, the Issuer’s Management Board does not foresee any risk to the continuation of the Issuer’s activities. The Issuer’s liquidity position remains balanced, while profitability indicators show consistent improvement. At the end of the third quarter of 2024, the Capital Group’s cash position was PLN 138.8 million, compared to PLN 137.9 million for the same period in the previous year. This position offsets the financial debt amounting to PLN 393.7 million as of 30 September 2024 (compared to PLN 322.3 million as of 30 September 2023), resulting in a net financial debt of PLN 254.9 million for the Q1–Q3 period, compared to 184.4 million, and was approx. 38% higher compared to the corresponding period last year.

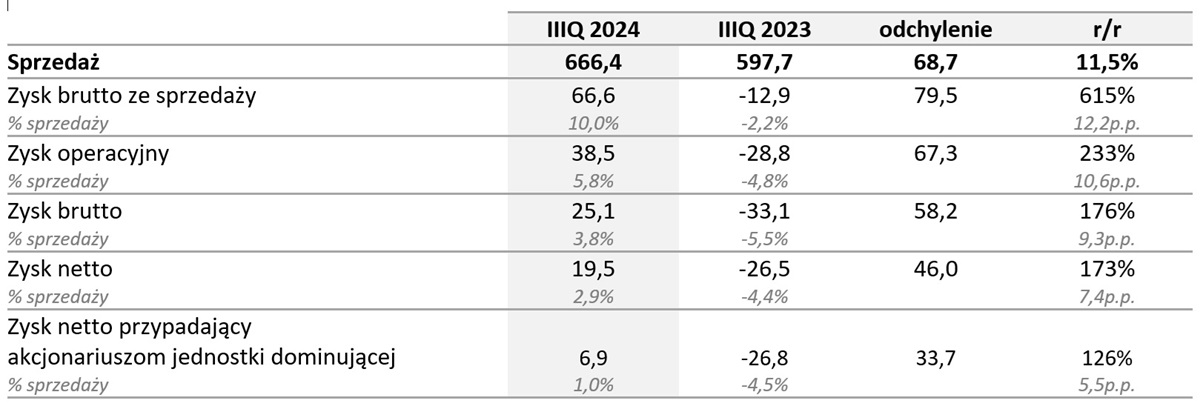

At the same time, the Board would like to highlight the financial results achieved for the third quarter of 2024, ending on 30 September 2024, compared to the same period of the previous year. These figures indicate a clear improvement in the Capital Group’s profitability, resulting from numerous initiatives launched at the beginning of the current year by the management boards of the companies that form the Unibep Capital Group. These figures are as follows:

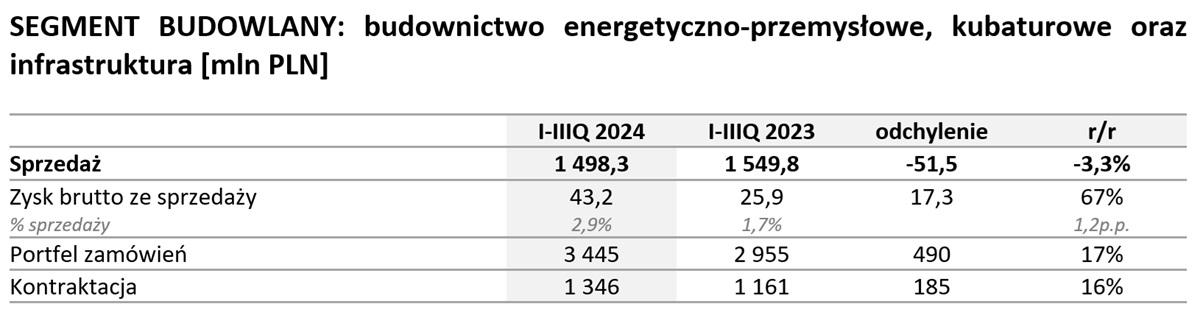

Throughout the Q1–Q3 2024 period, the construction segment, which includes the industrial and power construction, structural construction, and infrastructure sectors, reported sales of PLN 1,498.3 million, representing a decrease by 3.3% year-on-year).

The decrease was most significantly impacted by negative deviations in the power and industrial construction (decrease of 35.0% year-on-year), which includes reduced production capacities and the cessation of the Umicore contract, a result of mutual termination of the construction agreement by Unibep SA and the ordering party, as reported in the Issuer’s Management Board in current reports No. 10/2024 and No. 11/2024. The Power and Industry sector, which formally began operations relatively recently (in the first quarter of 2022), had been actively expanding throughout 2023 through increased contracting and acquisitions that began in 2022 and continued into the previous year. The Issuer’s current activities in this segment are balanced, with contracts and orders signed selectively, while the sales level variance presented above is mainly due to the high base effect from 2023 This is part of the mid-term strategy outlined in previous public statements by the Management Board, which aims to achieve a lasting improvement in the operational profitability of the entire construction segment of the Issuer. Therefore, when analysing the data for the three quarters of 2024, as well as data in subsequent quarters compared to the same periods in the previous year, an important factor explaining changes will be the effect of the so-called high base.

The level of contracting in the power and industrial construction segment is worth noting, as it amounted to PLN 270 million in the analysed three quarters of 2024 (the Board provided information about the signed contracts in the current reports throughout the period). This represents a significant step in executing the strategy outlined by the Board at the beginning of the year, aiming at enhancing the Capital Group’s activity specifically within this area of the construction market.

The revenue from sales recorded in the Q1–Q3 2024 for structural construction indicates slight change compared to the comparable data for the corresponding period last year (a decrease of 8.3% year-on-year). This area encompasses both domestic activities and operations in Eastern markets. In 2023, the Capital Group began the construction of the Polish Embassy in Minsk, and in the second quarter, the implementation of the “Szeginie” border crossing on the Ukrainian-Polish border (on the Ukrainian side). This is a contract signed in the current year, through which the Capital Group has reestablished its economic presence in the Ukrainian market. The Management Board would like to point out that, similarly to the power and industrial construction segment, the contracting and acquisitions in structural construction also employ a selective strategy. It ensures that contracts acquired for execution have safe estimated operating profitability and will contribute to a sustainable improvement in the profitability of the entire construction segment of the Capital Group in future periods.

Within the entire construction segment, the Capital Group recorded a very strong increase in sales revenue (by 67.9% year-over-year) in the infrastructure segment. This is due to the fact that many contracts in this sector are executed in the “design and build” formula, which extends the start of construction work. Currently, many of the contracts signed in 2023 are still in the design phase, but some have entered the implementation phase, which enabled the aforementioned increases compared to the data for the previous year.

As a result of the above-mentioned factors, the total sales revenue of the construction segment achieved in the analysed three quarters of 2024 was only 3.3% lower compared to the previous year.

On the other hand, the gross profit from sales achieved in the three quarters of 2024 shows a clear upward trend compared to the data from 2023. In the current year, the construction segment reached PLN 43.2 million, compared to PLN 25.9 million (an increase of 67%).

In the three quarters of 2023, the results of this segment in some cases already included provisions for estimated contract losses, arising from the materialisation of inflationary pressures and the inability to apply appropriate and adequate contract revaluation (particularly for private contracts). As a result, it became necessary to gradually revise downward the projected profitability of the ongoing contracts, with the culmination occurring in the fourth quarter of 2023.

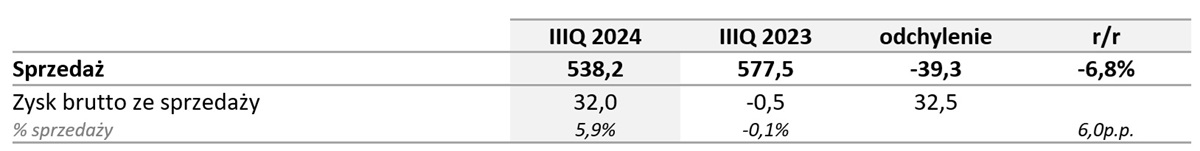

In the current year, although this phenomenon occurred in the first half of 2024, as the Management Board of the Capital Group outlined in previous reports, its scale during the entire analysed period of Q1–Q3 2024 was significantly smaller compared to the previous year. As a result, the gross results for the third quarter of 2024 achieved by the construction segment, compared to the corresponding period in 2023, indicate a clear improvement:

The aforementioned necessary revaluation of estimates results from the so-called “prudence principle in the valuation of construction contracts.” These losses had a one-time impact on the results due to the creation of appropriate reserves, with no effect on subsequent periods.

In the current year, this phenomenon occurred in the first half of 2024 and, in the vast majority of cases, concerned contracts that were still in the process of final acceptance of construction works. The Management Board would like to point out that contracts with a recognised loss at the gross profit level from sales in this manner have either been completed or will be completed in the current year. This means that the quality of the order portfolio to be executed in the following periods is gradually and consistently improving.

As a result of the aforementioned factors, the gross profit margin from sales improved, rising from +1.7% to +2.9%, including

- For the industrial and power sector: a decrease in the gross profit margin from a gross profit of 3.7% to a gross loss of -8.4%;

- For the structural construction segment (domestic and export): an increase in the gross profit margin from 0.6% to 4.2%;

- For the infrastructure segment: an increase in the gross profit margin from 2.0% to 7.8%.

It is also important to point out that during the Q1–Q3 2024 period within the construction segment, the Capital Group secured contracts with a total value of over PLN 1.3 billion (exceeding figures from the corresponding period last year). Thus, the backlog of orders for this segment for the upcoming periods reached a value of approximately PLN 3.4 billion, representing an approximate increase by 17% compared to the similar period last year.

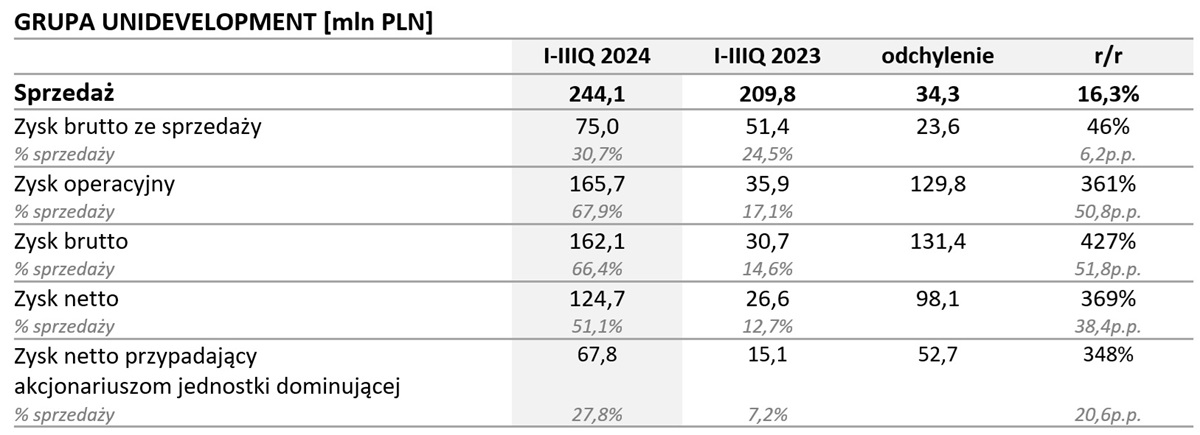

The sales of the development segment for the three quarters of 2024 amounted to PLN 244.1 million compared with PLN 209.8 million in the corresponding period of the previous year. The segment’s revenue increase of approx. 16.3% year-over-year was in line with the assumptions derived from the schedules of ongoing development projects. In the first nine months of 2024, the residential units delivered to clients came from more profitable development projects than in the same period in 2023, as evidenced by a gross profit margin of 30.7% compared to 24.5% for the three quarters of 2023.

In the results for this segment over the three quarters of 2024, the Capital Group recognised the sale (based on handover reports) of 386 residential units, compared to the sale of 441 units in the same period of 2023. The aforementioned financial result is primarily influenced by the handover of residential units in the joint venture investment Fama Jeżyce 3 in Poznań (where 330 units were handed over through handover protocols) and in the following housing estates: Idea Venus estate and Idea Ogrody estate in Radom, as well as Pauza Ochota in Warsaw.

In the current period, the developer sales reached a volume of 171 residential units (including 50 within joint ventures), compared to 161 units (including 161 within joint ventures) in the similar period of 2023.

In the analysed period of Q1–Q3 2024, the volume of the aforementioned development sales was affected by the project timelines of companies within the Unidevelopment Group, as well as market conditions that resulted in limited availability of mortgage loans and some clients deferring purchasing decisions, along with the overall sentiment and climate in the Polish development market. Since the end of Q3 2024, however, companies within the Unidevelopment Group have observed increased client activity and a noticeable rise in the number of reservation agreements being signed. During the discussed period, the Unidevelopment Group expanded its offer to include apartments in a new investment on the Warsaw market, and also continued preparations for the implementation of additional planned development investments.

As a result of the financial data aggregation process, preliminary estimates for the nine months of 2024 indicate that the Unidevelopment Group achieved an operating profit of PLN 165.7 million during the analysed period, compared to PLN 35.9 million recorded in the corresponding period last year.

The greatest impact on the level of operating profit in the three quarters of 2024 had the decision of Unidevelopment Group to cease development activities on selected land properties and to hold these properties to increase their value. The result of this decision was the reclassification of the aforementioned properties as investment properties, leading to their valuation at fair value. Additionally, actions were taken to sell part of the land bank through direct transactions, which resulted in the sale of a property in Coopera Street in Warsaw in the second quarter of 2024.

The positive impact of the above actions on the presented preliminary results is as follows:

– Operating profit: PLN 103.2 million

– Net profit: PLN 83.6 million

– Net profit attributable to shareholders of the parent company: PLN 48.1 million

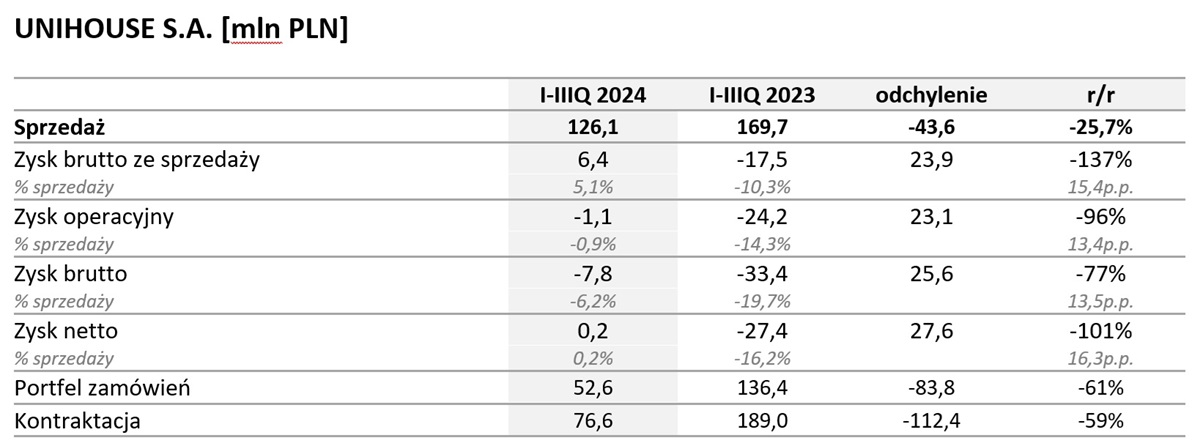

For the three quarters of 2024, the modular segment managed and overseen by Unihouse SA achieved sales of approx. PLN 49 million, which is over PLN 43 million less than in the corresponding period last year (decrease by 25.7%). Operating profitability reached PLN 1.1 million and was significantly better (by PLN 23 million) compared to last year.

The current sales level and the results achieved were influenced by the decisions made by Unihouse SA at the turn of the third and fourth quarters of 2023. The following organisational changes were made at that time to adjust the production capacity of the plant in Bielsk Podlaski to the current economic and market conditions. Today, this is reflected on the one hand in lower sales, but more importantly, in significantly better profitability at the EBIT level. The production volume of Unihouse SA for the first three quarters of 2024 amounted to 9,877 m2 (decrease of approx. 59% year-over-year), the main reasons for which are:

a) The prolonged recession on the German market;

b) The weak condition of the Norwegian market, which has historically been the core of operations, caused by difficulties in securing optimally profitable contracts, amid a nearly 6% appreciation of the PLN since the beginning of 2024.

c) Still insufficient activity from Polish investors and clients in the modular construction sector.

However, from the beginning of 2024, the Management Board of Unihouse SA, operating in this market segment, has been actively expanding its penetration of the Polish and Scandinavian markets, resulting in the acquisition of 8 contracts in these regions. The work in the German market is also continued. The Management Board wishes to point out that despite the significant year-on-year decline in production, Unihouse continues to execute contracts signed in previous periods, while maintaining a positive EBITDA. Additionally, during the reviewed period, the contracting level amounted to approx. PLN 77 million, which translates into a backlog of orders for execution in future periods worth approx. PLN 53 million.

The contracting level for the three quarters of 2024 was approximately 59% lower compared to the previous year. However, two contracts worth PLN 35 million were signed after the reporting date and several other significant contracts in the Polish and German markets are in preparation and development, with decisions expected at the turn of 2024 and 2025. The Management Board of Unihouse SA positively assesses the prospects of acquisition activities focused on the Polish and German markets, where the Unihouse brand is already well-known. In the area of projects to be acquired, there are contracts with a total value of nearly PLN 500 million.

THE OUTLOOK

The Management Board of the Issuer, as well as the management boards of the subsidiaries forming the Unibep Capital Group, will continue to pursue a policy of choosing contracts selectively in the construction and modular segments, ensuring optimal economic outcomes. On the one hand, such a policy might slightly limit the growth dynamics of construction and modular activities; on the other hand, it will definitely and positively contribute to further improvements in operational profitability in future reporting periods. In the case of the development segment, the Management Board will continue to implement sales plans in accordance with schedules for individual investments and a carefully considered pricing policy for individual customers.

As previously mentioned, during the entire Q1–Q3 2024 period, the Unibep Capital Group acquired contracts in the construction segment with a total value of over PLN 1.3 billion. Consequently, as of 30 September 2024, the backlog of orders for upcoming periods amounted to approx. PLN 3.4 billion, compared to PLN 3.0 billion as of 30 September 2023. At the same time, the value of contracts pending signature, where the Issuer’s offer ranked first in the bidding process or has been signed after the reporting date, currently amounts to PLN 0.4 billion. Additionally, new orders totalling PLN 0.1 billion have been acquired and signed just recently from this group of pending contracts.

In the opinion of the Management Board, the greatest prospects for contracting lie in the infrastructure and power and industrial construction segments. Under the infrastructure segment, the value of contracts already signed in 2024 amounted to PLN 0.66 billion as of 30 September 2024, while contracts currently pending signature total an additional PLN 0.1 billion. Once the remaining contracts are signed, the backlog of orders in infrastructure will total approx. PLN 1.8 billion, which the Management Board believes will allow for stable operations over the next three years.

In the coming quarters, the infrastructure segment will focus on leveraging the potential related to geographic diversification and further increase of the share of large contracts in the backlog of orders.

In the power and industrial construction segment, the Capital Group is currently engaged in advanced discussions on several large projects, including those involving potential technological partners. The Management Board of the Issuer continues to see significant opportunities in submitting offers in the energy sector, including power transmission and distribution, cogeneration, and renewable energy. As of 30 September 2024, the value of contracts signed in 2024 amounted to PLN 0.3 billion, while contracts currently pending signature total an additional PLN 0.28 billion. After their signing, the backlog of orders in this area will amount to approx. PLN 0.8 billion

In the area of structural construction (domestic and export), contracting activities will focus on a selective approach to new orders and on seeking projects with the highest bid profitability. As of 30 September 2024, the value of contracts signed in 2024 amounted to PLN 0.4 billion while the backlog of orders in this area amounts to approx. PLN 1.22 billion

The Management Board of the Capital Group will continue difficult negotiations on several active contracts in the construction segment to agree with the ordering parties on adjustments and relevant amendments increasing the value of orders. The impact of these actions is difficult to assess due to the rigidity of the existing contract provisions.

The Management Board of the Capital Group anticipates continued stable growth and the achievement of goals set for the development segment. It is worth noting that the development scenarios for this segment include new models of cooperation with external partners, as well as expanding the developer offering to include apartments outside the popular segment

The Management Board of Unidevelopment SA (the parent company of the Unidevelopment Capital Group), like the entire Unibep Capital Group, perceives the current slowdown in the development market as a temporary pause in its continuous growth. The demand for apartments in our country remains high, and Unidevelopment SA has the necessary know-how and a well-known, recognisable brand that enables further growth and the use of opportunities within the sector. The Management Board of the Issuer is confident that the competencies, experience, and market position it holds enable the implementation of new investments, both independently and in collaboration with external partners. With the continued improvement in the financial situation of the entire Unibep Group, we anticipate a dynamic acceleration in the development of the development business, including the introduction of many new investments in the development portfolio.

In the case of the subsidiary Unihouse SA, the Management Board of Unibep SA decided to take steps towards the potential sale of 100% of Unihouse shares, as announced in current report no. 70/2024. The Management Board indicates that the outcome of the actions related to the potential sale of all Unihouse shares is uncertain, and the final shape and form of any potential sale transaction will be determined through detailed negotiations with entities interested in Unihouse shares, which, according to initial forecasts, should take place in the first quarter of 2025. At the same time, based on the implemented market segmentation program, the contracting strategy is being executed, which focuses on the German and Polish markets. Based on this, the Management Board of the Issuer expects that the indicated bidding activities will secure module production to the extent necessary to achieve operational breakeven

In the first quarter of 2024, the Management Board of Unibep SA conducted a thorough review of internal processes, ranging from the acquisition process to collaboration with support teams, and ending with oversight on construction sites. The main internal optimisation activities continuously aim at restructuring the financial control system and strengthening operational control processes as well as risk management processes.

The Management Board of the Issuer wishes to point out that the presented financial data of the Capital Group represents a true and accurate reflection of the knowledge held in this respect as of the publication date of this study.

The Management Board of the Issuer is confident that the aforementioned measures will yield measurable benefits in 2024, both financial and performance-related, and will contribute to sustaining the trend of improving operational profitability across the entire Capital Group in the coming quarters.