Management commentary on the preliminary estimated financial data of the Unibep Group for 2023

Management Board of UNIBEP S.A. (the “Issuer”) hereby informs that due to the fact that the process of aggregation of preliminary financial data carried out for the purpose of the process of preparing financial statements for 2023 was completed on 11 March 2024, the Issuer decided to disclose to the public the preliminary estimated selected financial and operational data of the Unibep Capital Group (the “Capital Group”) for 2023, which was published on that date in the stock exchange ESPI system.

In this paper, the Issuer's Management Board would like to comment on the preliminary estimated data presented.

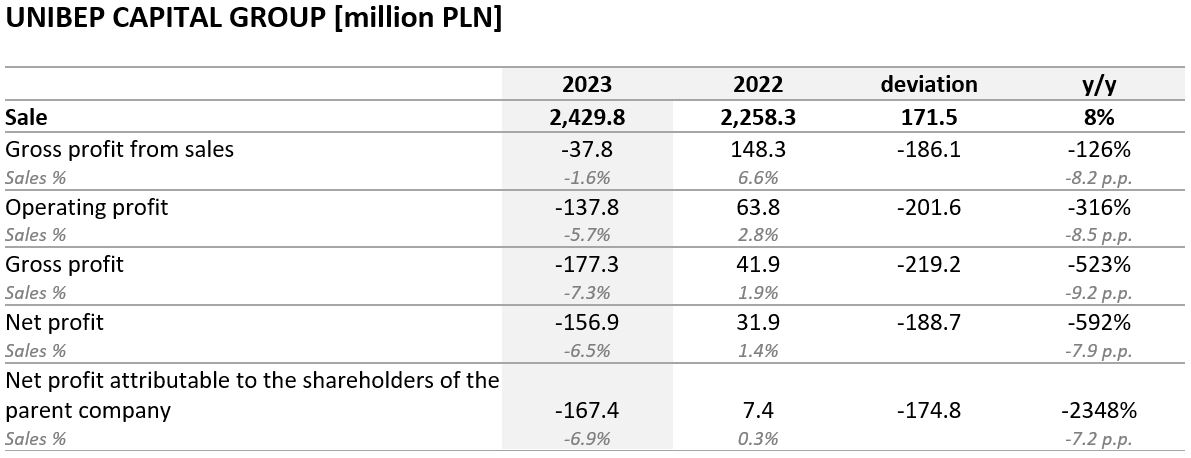

The Capital Group 's operations for the four quarters of 2023 generated revenue from core activities in the amount of PLN 2.4 billion, which constituted an increase by approximately 8% as compared to the same period last year. The increase in turnover was mostly attributable to the construction segment (over +8%), mainly as a result of higher sales in the following sectors: energy and industrial construction (+65%) and residential and commercial construction (+9%), while revenues recorded in the infrastructure (-29%) and real estate development (-5%) sectors dropped.

In the analysed period of 2023, the Capital Group achieved an operating loss of approximately PLN -138 million. As compared to the previous year, which recorded an operating profit of approximately PLN 64 million, this represents a negative deviation by more than PLN -200 million.

The aforementioned situation was influenced by factors of both internal and external nature. Undoubtedly, the biggest contributor to this situation was the cumulative materialisation of operational risks that naturally accompany the day-to-day business activities of companies operating in the general contracting segment. The difficult financial situation of the Capital Group and the expected negative forecasts for the entire year were signalled by the Management Board in earlier communications and meetings with the Issuer's stakeholders.

On the one hand, the presented preliminary estimated results for 2023 take into account the recognition of higher costs of construction output in the scope of many contracts realised in the construction segment, while on the other hand, in the scope of those contracts where completion dates are approaching, contract valuations were adjusted downwards due to the lack of obtaining the relevant agreements or annexes from the employers taking into account the additional payments. In addition, the valuations of contracts the timeliness of which is at risk, has taken into account the negative economic impact on their operating result.

The results were negatively affected by global inflation phenomena. It is worth pointing out, however, that the difficult macroeconomic situation in Poland and worldwide has also affected many investors (e.g. through higher investment financing costs). It has translated all the time into a reduced willingness on the part of employers to renegotiate contractual terms and conditions of the construction contracts to the extent that they would be able to cover the resulting profitability gap in a satisfactory manner.

The previously announced conservative approach to maintenance provisions, provisions for potential liabilities and the manner and time of recognition of additional revenue in the construction segment has also been included in the forecast operating performance estimates.

The Capital Group's results also include the cost of downtime related to unused production capacity at the modular building factory of Unihouse S.A. and lower-than-assumed resulting effects from contract award procedures in the scope of construction projects acquired in 2023.

In addition to the operating factors indicated above, the Capital Group's estimate results were also affected by the result on financing activities (a deterioration of approximately PLN 17 million y/y), mainly due to higher interest expenses and the valuation of financial assets such as write-downs of receivables, in particular on export markets.

As a result of the above mentioned non-recurring factors, the estimated net profit of the Capital Group was lower by approximately PLN 190 million than in the previous year, while the difference between the Capital Group's net profit and the net profit attributable to shareholders of the parent company is due to contracts executed under the joint venture (JV) formula, the result of which is partially excluded from the profit attributable to shareholders of the Issuer. The preliminary figures presented for 2023 recognise the results from two such contracts relating to real estate development activities.

The Issuer's Management Board, according to its current knowledge and as at the date of publication of this report, does not see any risk for the going concern of the Issuer’s activities. At the end of 2023, the Capital Group's cash balance stood at PLN 311 million, as compared to PLN 138 million in the same period of the previous year. This item naturally neutralises the financial debt amounting to PLN 328 million as at 31 December 2023 (as compared to PLN 241 million in 2022), resulting in a net financial debt of only around PLN 17 million in the analysed period, as compared to PLN 103 million in the same period of the previous year.

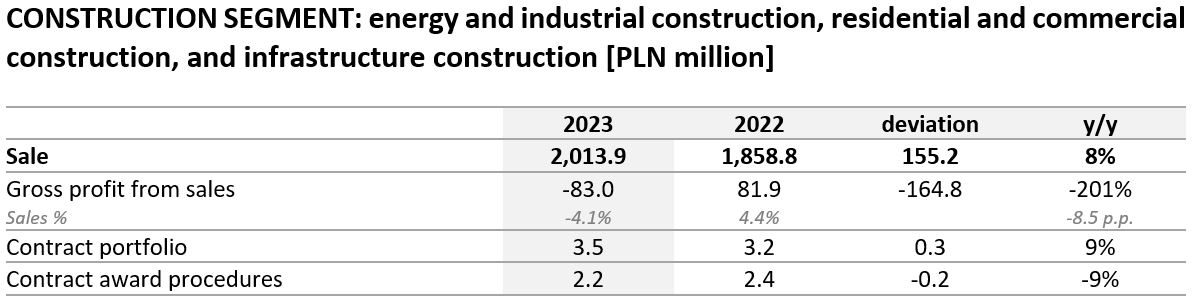

CONSTRUCTION SEGMENT: energy and industrial construction, residential and commercial construction, and infrastructure construction [PLN million]

Throughout 2023, the construction segment, which includes the energy and industrial construction, residential and commercial construction and infrastructure construction sectors, recognised sales in excess of PLN 2 billion (increase by 8% y/y). The highest turnover dynamics were in the energy and industry sector (+65% y/y), for which the indicated increases were largely due to the so-called 'base effect'. During 2023, the area was experiencing a boost its activities, which were formally launched quite recently, namely in Q1 2022. As a result, the increase in revenue in this part of the construction industry was reflected in large number of awarded contracts dating back to 2022 and continuing into 2023. Revenue growth of 9% was recorded in the residential and commercial construction sector. This area also includes activities in Eastern markets, where in 2023 the Capital Group began construction of the Polish Embassy in Minsk. Within the construction segment as a whole, the decrease in turnover (by 29% y/y) occurred only in the area of infrastructure. It is a result of the fact that many of the sector's contracts are carried out on a 'design and build' basis, which extends the timing of the start of construction work. Such design work is currently underway on a number of contracts signed in 2023, and the first construction activities will take place at the end of this year. In addition, in 2022, the Capital Group acquired and completed the task of building a dam on the eastern border, which affects the high y/y comparative base for this sector of the Capital Group's business.

From the point of view of operating results, the year 2023 passed under the influence of the inflation phenomena, which affected very negatively the Group's ability to maintain the profitability levels recorded in the corresponding period of 2022. These include, in particular:

- unprecedented increases in the prices of certain groups of materials, including further increases in 2023 in the prices of certain building materials such as cement and lime (approx. 44%), insulation materials (+22%) or construction chemicals (+16%),

- a permanent shortage of blue-collar workers and certain groups of skilled workers already visible in 2022, and linked to the outflow of workers from Ukraine,

- rising labour costs due to increases in the minimum wage, amended twice in 2023 by the Polish government (by a total of almost 20%), resulting in above-average increases in labour costs.

Over the course of 2023, the Capital Group's Management Board sought to take active steps to attempt to amend the contractual terms and conditions of subcontracted general contracting tasks. Their intensity was high especially in the second half of 2023, however, they ultimately failed to deliver the expected results. In fact, in a very large number of cases, a rigid negotiating attitude was encountered on the part of the employers, often linked to their lack of access to additional sources of financing.

In the group of private contracts, the aforementioned phenomena contributed directly to the decline in the Capital Group's operating profitability in 2023. This is particularly the case in the residential and commercial construction sector, where construction contracts do not have the relevant escalation clauses and it is only possible to obtain compensation or annexes increasing the value of contracts based on the relevant agreements between the parties. In addition, the domestic market during 2023 showed a negative trend in the supply of new bids in residential construction resulting in increased competition from general contractors, which resulted in dropping bid margins. In view of the inflation phenomena indicated above, this has reduced the profitability of the Capital Group's ongoing contracts from this part of the contract portfolio.

On the other hand, as regards public road contracts, under the influence of many appeals made by the Polish Association of Construction-Industry Employers (PZPB), the government side adjusted the indexation limit from 10% to 15%, but in the end this change only applied to contracts signed before the outbreak of war in Ukraine. For the Capital Group, this additional element very often remains unattainable and indexation is only limited to the previous limit of 10%, which does not allow the budgets of ongoing contracts to be fully balanced.

As a result, gross profitability on sales decreased, indicating a decrease from a gross profit on sales of +4.4% to a gross loss on sales of -4.1%, of which:

- for the energy and industry sector: a decrease in gross sales margin from a gross profit on sales of 9.0% to a gross loss on sales of -12.6%,

- for the residential and commercial sector: a decrease in gross sales margin from a gross profit on sales of 2.0% to a gross loss on sales of -1.1%,

- for the infrastructure sector: a decrease in gross sales margin from a gross profit on sales of 6.6% to a gross loss on sales of -1.5%.

The aforementioned deterioration in the operating results of the Capital Group's entire construction segment is primarily the result of the aforementioned increasing costs of ongoing construction projects, on the other hand, the conservative approach in estimating the Group's actual ability to obtain additional payments and annexes from the employers.

It is also worth mentioning that throughout 2023, within the construction segment, the Capital Group acquired contracts for implementation, the total value of which reached approximately PLN 2.2 billion. Thus, the portfolio of contracts in this segment for execution in 2024 and in the years to come reached a value of approximately PLN 3.5 billion, an increase of approximately 9% as compared to the contract portfolio recorded in the same period of the previous year. UNIDEVELOPMENT GROUP [million PLN] |

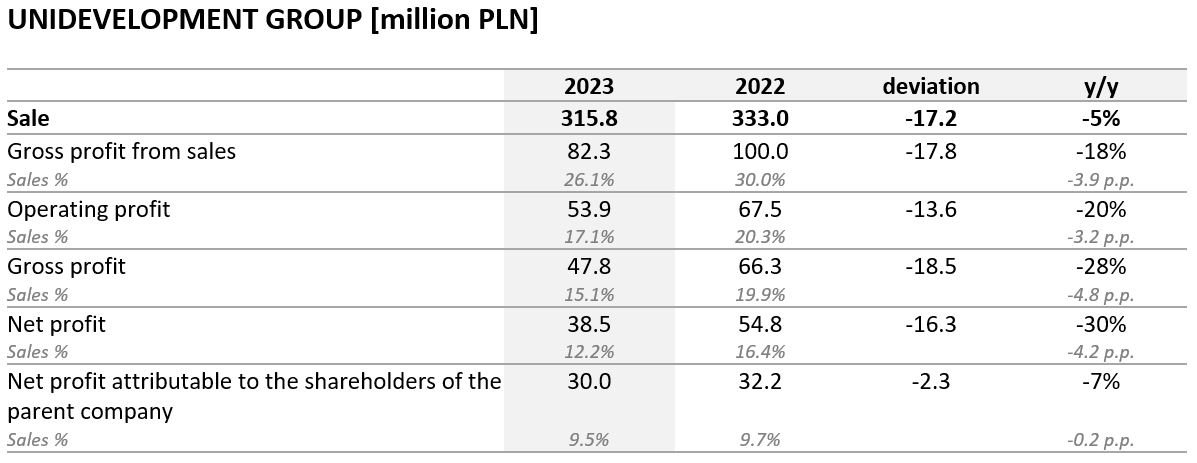

Sales of the real estate development segment for the four quarters of 2023 amounted to approximately PLN 316 million, as compared to PLN 333 million in the same period of the previous year. The decrease in the segment turnover of around 5% was in line with the assumptions based on the schedules of ongoing real estate development projects. It is worth noting that the ongoing projects have met with great interest from clients.

In the results of this segment for the four quarters of 2023, the Capital Group recognised sales (apartment handover protocols) of 584 premises (including 271 as part of joint ventures), as compared to sales of 604 premises (including 294 as part of joint ventures) in the corresponding period of 2022. The aforementioned financial result is mainly influenced by the handover of projects in the following housing developments: Fama in Poznań, Idea in Radom, Latte in Warsaw and Pauza Ochota in Warsaw.

At the same time, the real estate development sales reached a volume of 423 premises (including 203 as part of joint ventures) as compared to 635 premises (including 454 as part of joint ventures) in the corresponding period of 2022.

As a result of the financial data aggregation process, the preliminary financial data estimates for the full year 2024 show that the Unidevelopment Group generated an operating profit of PLN 53.9 million (as compared to PLN 67.5 million for the same period last year). The slight decrease in the profitability of this segment was due to the sale of a significant part of premises to institutional clients, which is always associated with the realisation of lower margins than in the case of sales to individual buyers.

Despite a slight reduction in the profitability of this segment, the Management Board does not anticipate negative trends on the real estate development market. On the contrary, in the view of the Management Board, the demand for new apartments in 2023 exceeded the level from 2022, which was mainly influenced by the increased availability of mortgage due to, among other things, the entry into force of the governmental “2% Safe Mortgage” housing programme. Furthermore, according to the BIK (Polish credit reporting agency) data, in 2023 the value of mortgages granted amounted to PLN 63.9 billion, an increase of nearly 40.5 per cent y/y. The increased demand for new housing has coincided with a low supply of premises on both the primary and secondary markets. The demand visible on the market allows us to look with optimism at the sales of apartments within the framework of the ongoing and planned real estate development projects and at the profitability of this part of the Group's operations in the following periods.

Given the current market situation, the main task within the real estate development segment remains the efficient and timely launch of new investments, with an attractive and market-oriented offer.

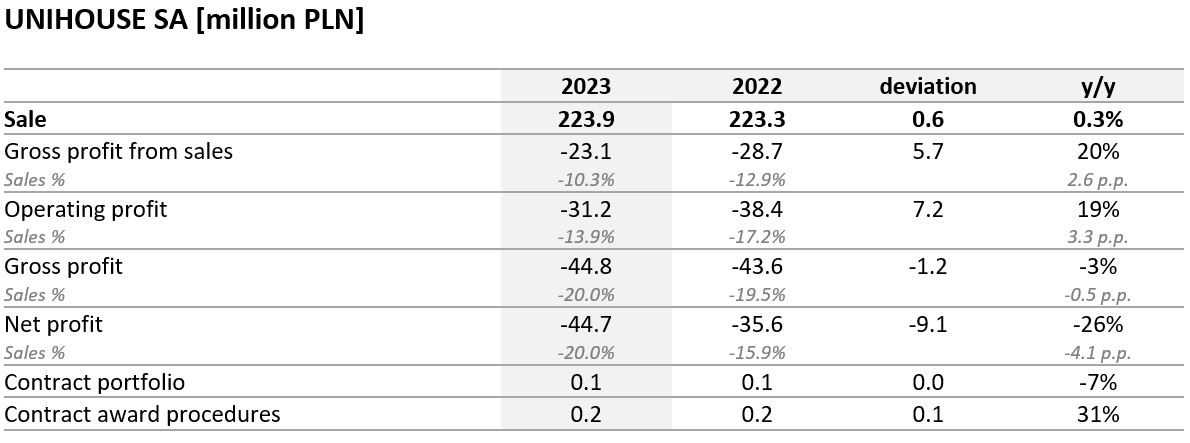

UNIHOUSE SA [million PLN]

In the previous year 2023, the modular housing segment realised and supervised by Unihouse S.A. achieved sales of approximately PLN 224 million, i.e. at a level similar to 2022. The operating profitability, despite its negative tone, improved by 3.3 percentage points as compared to the same period of the previous year.

In 2023, the Company carried out a number of reorganisation activities to adjust the level of production capacity at the Bielsk Podlaski plant to current economic and market conditions, but their scale, although bringing tangible economic benefits, was in no way able to neutralise the performance gap. The factor that had biggest impact was the adjustment of margins on ongoing contracts due to higher production costs, following unprecedented increases in material and subcontractor prices and higher freight and inland transport costs. A significant part of contracts continued to be executed in 2023 on the basis of fixed contractual terms and conditions, whereas the renegotiation of contracts and agreeing on additional payments with the employers to help neutralise the impact of inflation factors ultimately did not take place on a satisfactory scale. As a result, the Management Board of Unihouse S.A. has decided to start enforcing additional payments on this account through the courts, which will, however, be a lengthy process.

In the analysed period of 2023, the modular housing segment was mainly focused on the Scandinavian and German markets. These have historically been the main markets. However, the appreciation of the PLN against the EUR and particularly against the NOK (by 13.2% throughout the entire 2023) led to a significant decline in operating profitability on these export markets, while the German market in 2023 began to succumb to a deepening recession not sparing even the so far resilient modular construction segment. As a consequence, the production volume of Unihouse S.A. has decreased very significantly throughout 2023, which ultimately amounted to 30,365 m2 (decrease by 9.3% y/y).

In the period under review, the volume of contracts awarded reached approximately PLN 218 million, which translates into a contract portfolio for this segment to be realised in future periods worth approximately PLN 116 million. The volume of contracts awarded in 2023 was more than 30% higher than last year, but it is still insufficient for full production capacity utilisation. Good prospects for the future include concentrating the contract awarding on the Polish market and the German market, where the Unihouse S.A. brand is well-known. In the area of projects to be acquired, there are contracts with a total value of approximately PLN 500 million.

PERSPECTIVES

As indicated earlier, throughout the entire 2023, the Unibep Group has acquired contracts with a total value of approximately PLN 2.2 billion. Thus, the portfolio to be realised in 2024 and in the following years amounts to approximately PLN 3.6 billion. At the same time, the value of contracts to be signed, where the Issuer's offer is ranked first in the bidding process, is already approximately PLN 1 billion.

In the view of the Management Board, the areas of infrastructure and the energy and industrial sector have the greatest prospects in the scope of contract awarding. In the case of the former, the value of contracts already signed or to be signed in 2024 is approximately PLN 650 million. Once these are signed, the portfolio of orders from this area will amount to approximately PLN 2 billion, which, in the opinion of the Management Board, will allow for its stable functioning over the next three years. Over the next few quarters, the activities of the infrastructure area will focus on further exploiting the potential associated with geographical diversification and with increasing the share of large contracts in the contract portfolio. Within the energy and industrial business, the Group is currently conducting advanced discussions on several large orders, including with participation of potential technology partners. The Management Board still sees significant opportunities in commencement of bidding in the energy sector, including energy transmission and distribution and renewable energy. As regards residential and commercial area, activities will be contractually focused on a selective approach to new orders and the search for projects with the highest bid profitability.

In the near future, the Capital Group's Management Board will continue the difficult negotiations on a number of active contracts in the construction segment in order to agree on indexation and relevant annexes with the employers. However, the effect of these activities is currently difficult to assess, due to the rigidity of the existing contract provisions.

The Capital Group's Management Board assumes further stable development and achievement of the goals of the real estate development segment. However, given its responsibility towards its stakeholders, including banking institutions, insurers, bondholders and shareholders, as well as the Issuer's employees, the Management Board, in consultation with the Supervisory Board, has initiated a number of activities, including a review of options and scenarios that will reduce the Capital Group's financial debt by, among other things, raising capital from the sale of certain assets, reviewing the fair valuation of real estate development projects and optimising the process of managing the Capital Group's financial position and cash flows. These activities will, in the opinion of the Management Board, bring tangible benefits and their effect will be visible in the results in the coming reporting periods.

The scenarios for the development of the real estate development segment include new variants of cooperation with third party partners. This applies to both joint ventures projects and the possibility of involving a third party partner in making the activities of the Unidevelopment Group more dynamic. This would allow to launch new directions of expansion to other complementary housing segments or enable to make territorial expansion on the Polish market more dynamic.

The modular housing segment operated by Unihouse S.A. initiated a reorganisation programme in the second half of 2023, which included a review of the company's human and organisational resources and potential. The prospect of better results than in the previous two years will be ensured by the successful acquisition of construction contracts assumed to be realised in the first half of 2024 in Poland and on the German market. The Management Board anticipates that the indicated bidding activities will secure the housing module production to the extent that it will achieve a neutral result at the operational level as early as 2024. Unihouse S.A.'s strategic development directions also take into account options related to the involvement of a third party business partner or a change of ownership structure, which was initiated at the end of 2023.

Unibep SA's management board has also performed an in-depth review of its internal processes: from the acquisition process, through cooperation with support teams, to supervision at construction sites. The main optimisation measures within the organisation will therefore be aimed at redesigning the structures, including building and strengthening the operating control, internal control and risk management processes, focusing at achieving the synergy effect. The results of this work are now being formalised and their effects are reflected in internal action plans for individual teams and general revenue and performance visions for individual business segments.

The Issuer's Management Board is convinced that the aforementioned optimisation measures will bring tangible benefits of both financial and performance nature in 2024, and will allow to improve the overall operating profitability of the entire Capital Group. As a result, according to the current state of knowledge, the Issuer's operating result will reach 1% - 1.5%.